0

Total Financing

0

Payment Financing

0%

Total Default Rate

0

On-going Financing

0

Settled Financing

0

Aborted Financing

What is P2P financing and how does it benefit you?

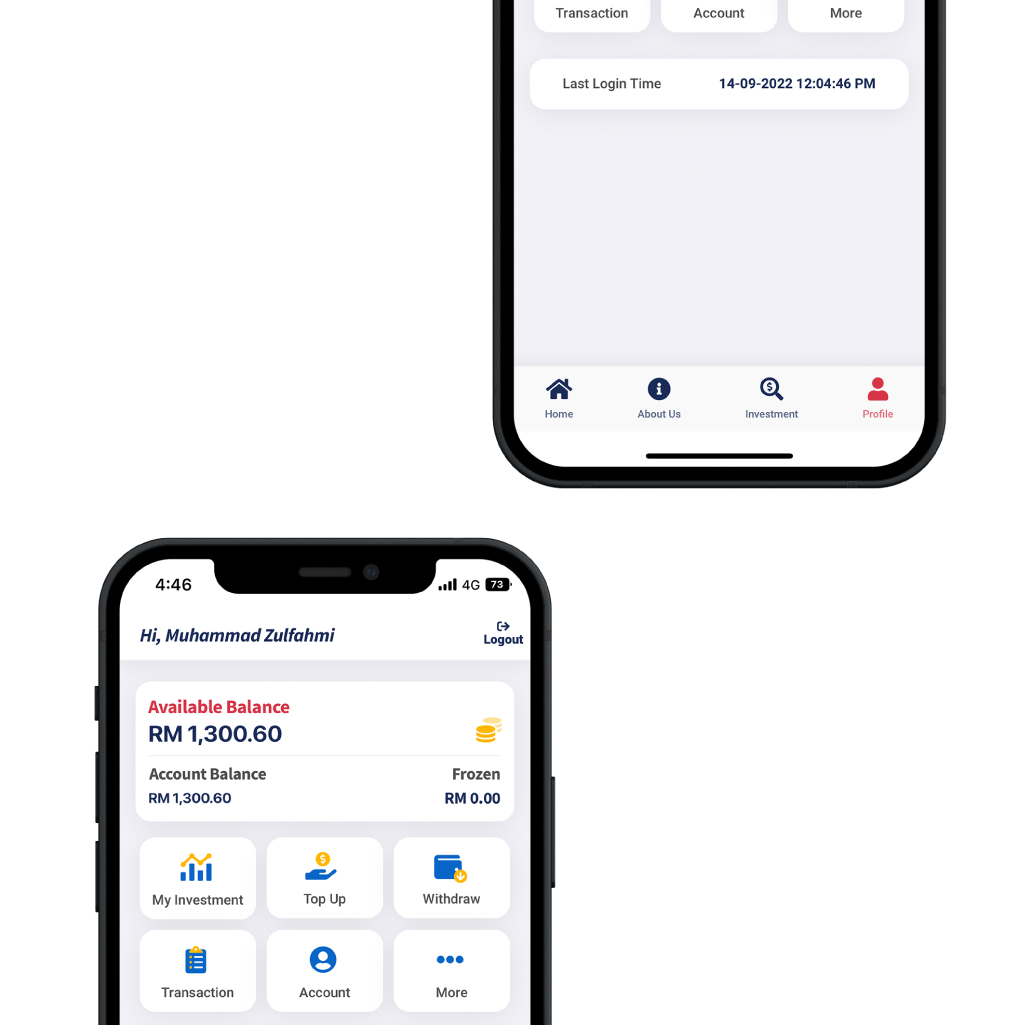

Peer-to-peer (P2P) financing is an innovative form of financing that allows SMEs to raise working capital funds from individual and institutional investors through P2P online platforms licensed by the Securities Commission Malaysia (SC). QuicKash is designed to marry investors with SMEs on our revolutionary P2P financing platform for the latter to grow their businesses.

By bypassing the traditional banking system and linking Issuers directly to potential Investors, we essentially provide businesses (Issuers) with access to alternative financing avenues.

Investors stand to benefit from attractive, risk-adjusted returns.

Watch Video to Learn How QuicKash Works for You

Interaction between Issuer and Investor

Benefits for Issuers

Gain Access to Transparent, Cost Effective, and Fast Loans

A Recognised Market Operator by Securities Commission Malaysia.

Quick and easy online application process with fast turnaround.

Faster access - possible to secure funds within days.

Competitive cost on financing from as low as only 8%.

Short to Medium Financing Tenor options (3 months to 2 years).

Benefits for Investors

Invest in SMEs you care about. Earn returns of up to 18%

Peace of mind. Our platform is regulated by the Securities Commission Malaysia.

High Returns on Investment of up to 18% p.a..

Ability to diversify your investment portfolio to balance risk.

Low investment entry point from RM100 only.

Safe investment platform. Funds are held in a trust account and licensed Trustee.

Start Investing Today!

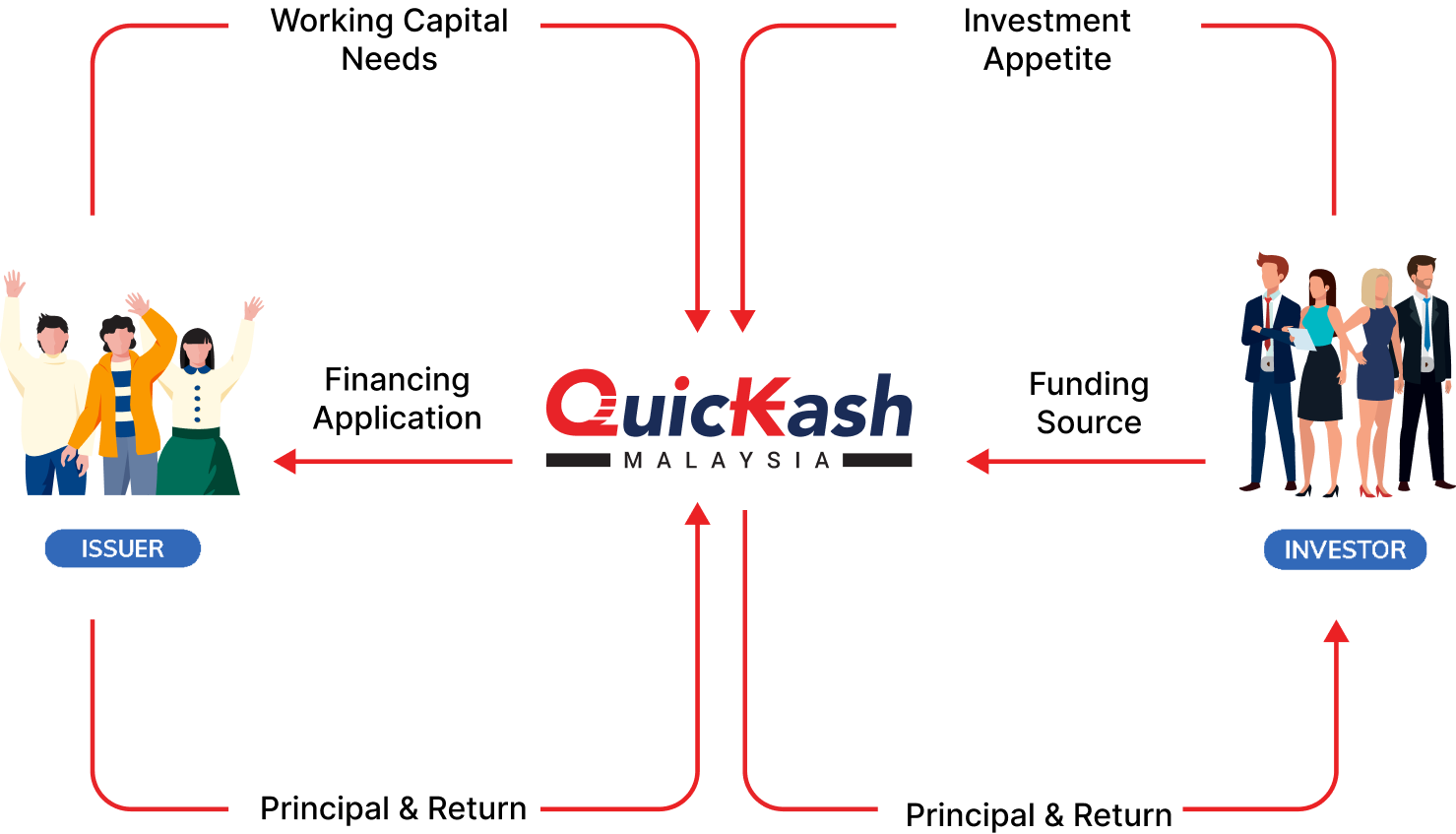

Once your registration is approved, you may proceed to invest...