Connecting Investors and SMEs for a Mutual Financial Growth

About QuicKash

QuicKash Malaysia is a fully owned subsidiary of ManagePay Systems Bhd (MPay) and is a Recognised Market Operator by the Securities Commission of Malaysia to operate a peer-to-peer financing platform.

Our Mission

We aim to bring businesses and investors together in a vibrant, innovative marketplace for peer-to-peer financing. It is our mission to build mutually beneficial partnerships between investors and businesses, which will ultimately contribute towards a more robust economic growth for our nation.

Connecting investors and businesses through P2P financing

Building mutually beneficial partnerships for financial growth

Contributing towards a robust economic growth with P2P financing

What We Do

With more than 20 years of collective experience and deep understanding of the fintech industry, we are dedicated to bring a smarter finance solution to the business owners and investors in Malaysia.

Our P2P financing platform is designed to allow SMEs faster access to business financing and give investors direct access to alternative investment avenue that can generate higher returns in an environment with risk-adjusted returns. Effectively, we are revolutionising the way businesses access credit and transforming the way investors invest.

To make it even more convenient for investors and businesses, our platform comes with a mobile application that allows you to access your investment portfolio anytime, anywhere!

Our Core Values

Our core values are driven by the fundamental belief of ensuring both investors and businesses gain mutual benefits from our P2P financing platform

About MPay Group

ManagePay Systems Bhd (MPay) is an investment holding company. The group’s operating segment is classified into two: Fintech Services and Non-Fintech services. Fintech services segment is involved in POS terminal services, third party acquiring, payment services, e-money and Mastercard card issuing, alternative financing business outsourcing services, and loyalty management services. The non-fintech services segment is involved in software and digital security, information communications, e-commerce, and technology services. Payment services is the major contributor to the group’s total turnover and revenue.

Leadership

Meet our visionary leader who is committed to helping Investors earn returns and businesses gain financing

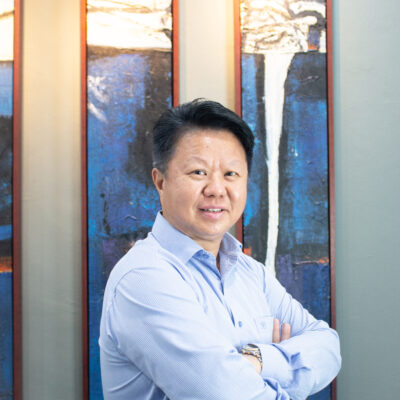

Dato’ Chew Chee Seng

Founder & Group Managing Director

Dato’

Chew Chee Seng is the Group Managing Director cum

Founder of ManagePay Systems Berhad (“MPay Group) and

is responsible for the formulation and implementation

of the overall business strategies and policies of

MPay Group, a company listed on the ACE Market of

Bursa Malaysia. Graduated in 1992 with an honour

degree in Bachelor of Science in Computer Science and

a General Studies degree in Business Management from

Universiti Sains Malaysia, Dato’ Chew began his

career as an Instrument Engineer cum Observer at the

world-renown oil and gas contracting company,

Schlumberger Limited. Then in 1994, he joined

Dataprep Holdings Berhad as the Account Manager

before leaving in 2000 to set up MPay Group.

He steered MPay Group to become a trusted

payment solution and service provider to financial

institutions in Malaysia. In 2011, he was

instrumental in listing MPay Group on the ACE Market

of Bursa Malaysia. In October 2012, MPay Group was

awarded by the Malaysian Government to implement an

Entry Point Project (EPP) to roll out Mobile Payment

Solution to small retailers under the Digital

Malaysia Masterplan. The Mobile Payment Solution

subsequently won the 2012 Frost & Sullivan Asia

Pacific New Product Innovation Award.

Over the last 10 years, Dato’ Chew has led

MPay Group to obtain multiple regulated business

licenses from various authorities, namely, Bank

Negara Malaysia (“BNM”), Securities Commissions

Malaysia (“SC”), Malaysian Communications and

Multimedia Commission (“MCMC”) and Ministry of Local

Government (“KPKT”). Along with the licenses, the

Group has invested in more than twenty different

companies across payments, credit, e-money, P2P

lending, digital ID, digital signature, e-commerce,

artificial intelligence, machine learning, data

analytics, blockchain, digital assets, and other

areas of Fintech.