Registered

with Securities Commission Malaysia

Products Offered

Program Financing

Purpose of Financing: Working Capital or Business Expansion

Amount: Ranging from RM 5, 000 to RM 300,000

Business Operation: Minimum of 1 year in operation

Who Can Apply: SMEs including retail, wholesale, and manufacturing businesses

Project Financing

Purpose of Financing: Working Capital or Business Expansion

Amount: RM 300,000 and beyond

Business Operation: Minimum 1 year in operation

Who Can Apply: Large-sized SMEs with greater working capital or project financing needs that are commensurate with the scale of business/project carried on.

How to Complete the Issuer Application Form

Once you

have registered for a Quickash account as

an Issuer, you can click the Apply Now

button below.

Fill in

the form based on your purpose of

financing, the amount of financing you

wish to request, and select the option

for collateralised or non-collateralised

financing.

Download

all required forms and fill them up and

sign them accordingly.

Please

submit all the additional supporting

documents listed in the required document

list.

Upload all

required forms along with all required

supporting documents and click "Submit".

Who Can Apply?

Any business that is registered with SSM may apply

Sole proprietorship

Partnership

Private limited company

Public listed entities and subsidiaries

Start Investing Today!

Download

Now

Download

QuicKash App via Google Play Store or

Apple App Store

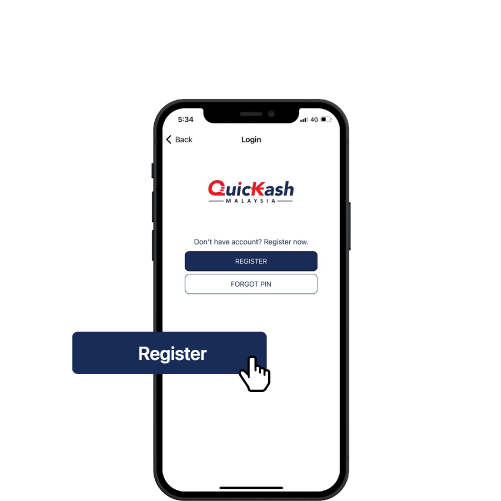

Register

Create

your account by filling up your details

and provide the required.

Create

Password

Create a

unique password to ensure safety and

security

Select

Investor

Select

register as "Issuer" and continue to

provide further documentation