1. Who can register as an Investor?

QuicKash accepts registrations from both individual and institutional investors. However, all investors, regardless of type, are required to undergo a screening process during the registration. As part of the verification process, personal documents will be requested to serve as proof of identity.

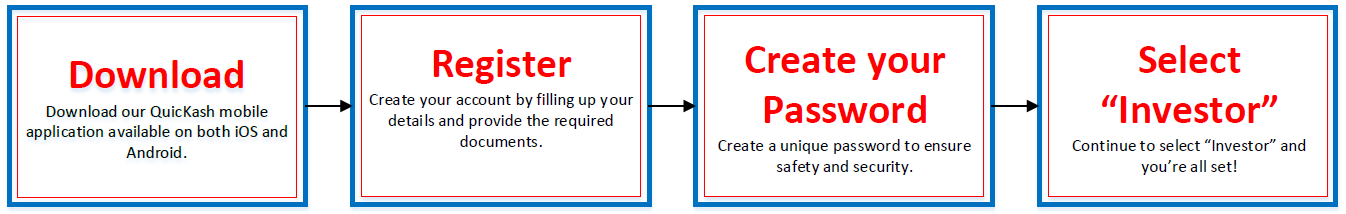

2. How do I register?

All registrations shall undergo a screening process and must be accepted for registration as an investor before being allowed to access your account with QuicKash.

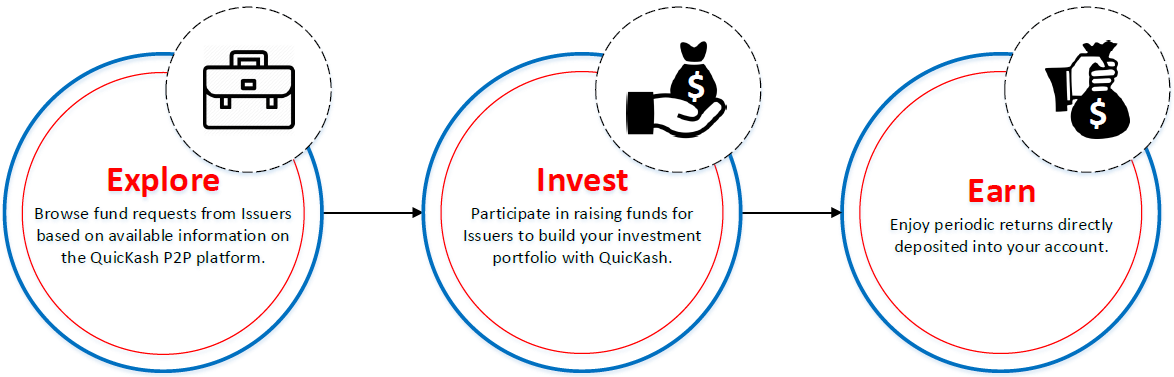

3. How does it work for an Investor?

4. How much can I invest?

A minimum investment amount of RM100.00 is required, and additional investments must be made in multiples of RM100.00. This applies to all investments up to the value of the respective investment note.

5. Is my personal information kept private?

Yes, all information submitted to QuicKash will be kept confidential. Our platform is compliant with the Personal Data Protection Act (PDPA). For more details, please visit our website and refer to the Privacy Notice displayed there.

6. What are the fees I have to pay?

In relation to investing in QuicKash P2P finvestment notes, Investors need to pay minimal fees, as follows:

a. Service Fee and Withdrawal Fee -Service Fee – not more than 1.35% on the repayment amount (includes Principal plus Interest).

Example :-

How do I calculate the service fee?

Investment Amount : RM 10,000.00

Interest p.a (%) : 10.00%

Tenure (Months) : 12

Total Payable Amount : RM 11,000.00 and Service Fee p.a (%) : 1.35%

Service Fee deducted for each repayment received :

= ([(Principal+Interest) * 1.35%] )/12

= (RM 11,000.00 x 1.35%)/12

= RM 12.375

b. Withdrawal Fee - Withdrawal Fee – RM1.00 per withdrawal.

7. Where is money placed once I transfer it to QuicKash?

QuicKash ensures that all deposited funds are placed in a designated trust account, as required by the regulator, Securities Commission Malaysia. The trustee appointed by QuicKash is Malaysian Trustee Berhad. This trust account is held in partnership with RHB Bank and managed by Malaysian Trustees Berhad, a licensed and trusted trustee institution.

This arrangement provides an additional layer of security and assurance for QuicKash users. The funds are held and managed in accordance with the regulations and guidelines set by the Securities Commission Malaysia, ensuring transparency and protection for the deposited funds.

Users of QuicKash can have confidence and peace of mind, knowing that their funds are securely held with Malaysian Trustees Berhad, a reputable trustee institution recognized by regulatory authorities.

8. Are investments made on QuicKash bound by contract?

Yes, investments made on QuicKash are bound by a contract between investors and issuers. These contractual documents are in digital form and copies are made available to both the issuers and investors. The contract outlines the terms and conditions of the investment, including the rights and obligations of both parties. It is important for investors to review and understand the contract before making an investment, as it governs the legal relationship between them and the issuer.

9. What happens to my money when I invest in an Issuer's fund?

When you invest in an Issuer's fund through QuicKash, the amount you invest will be locked-in (frozen) and pooled into a fund. This fund is then disbursed to the respective issuers for their financing needs. It's important to note that once you invest, the invested sum is not retractable or immediately withdrawable.

Therefore, it is crucial that you thoroughly study and analyse the nature and potential of the proposed investment before proceeding. Take the time to review the investment details, risk factors, and any other relevant information provided by QuicKash in financing factsheet. By conducting your due diligence and understanding the investment opportunity, you can make informed decisions that align with your financial goals and risk tolerance.

10. How can I withdraw my money?

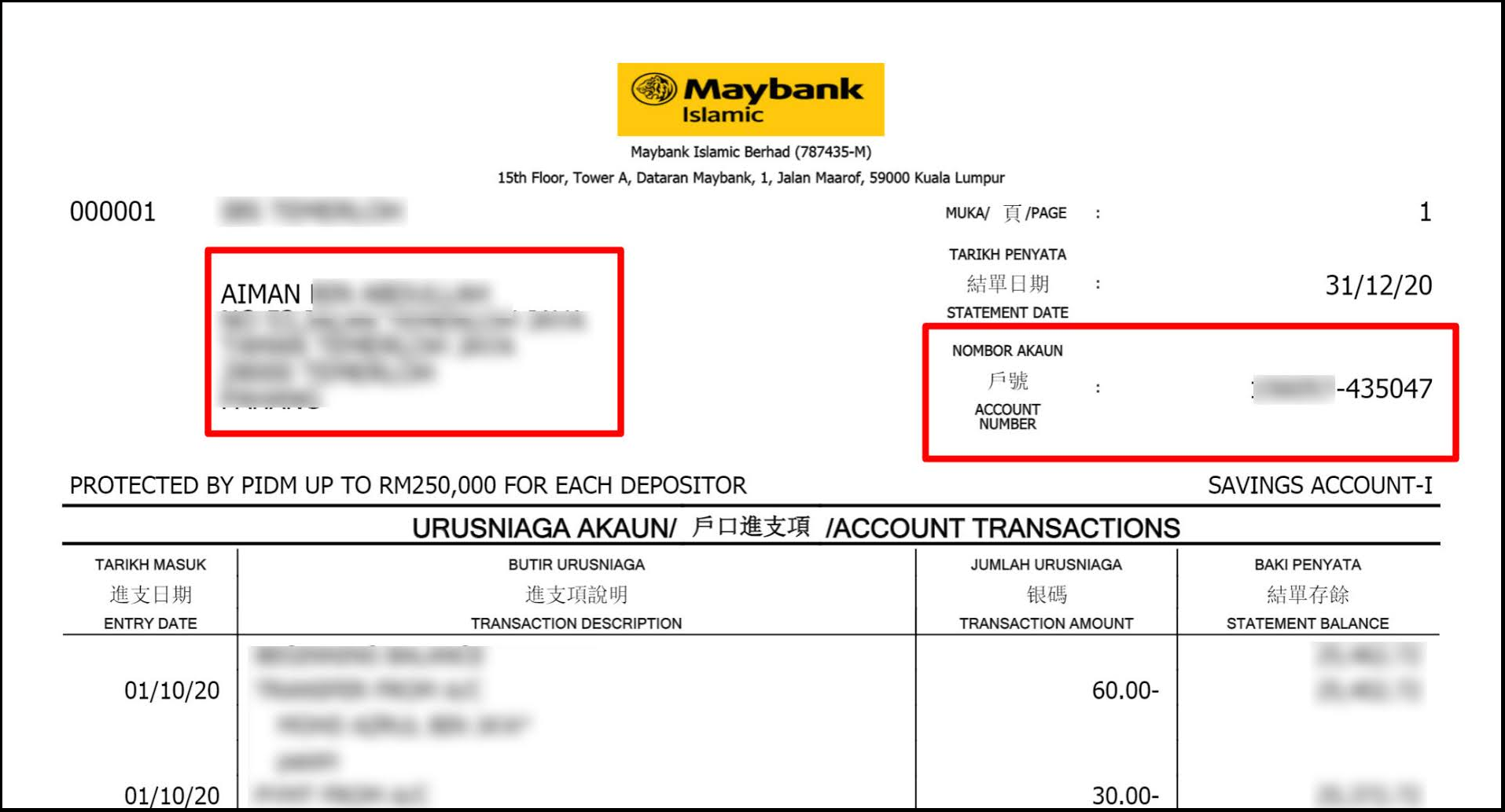

i) You may do so by transferring the collected returns to your own bank CASA account via our mobile application. Investors are required to successfully complete registration process of their respective bank accounts by submitting the following document(s) :

A graphic of your bank statement which clearly shows the logo of the bank, your name, address and bank account number. (*Sample picture of the bank statement attached for reference.)

ii) How long it takes for the money to be transferred to investor's CASA account after perform the withdrawal through QuicKash app?

Your CASA account will be credited with the withdrawn funds 1-3 working days after the withdrawal transaction has been performed.

11. Are there any minimum deposits / top up when setting up my account?

No, there is no minimum deposit requirement to register as a QuicKash Investor.

12. What is the minimum top up amount?

The minimum amount of top up that can be added into your QuicKash account varies based on the top up method used :

a. FPX - minimum RM100 for top up via FPX transfer.

b. MPay WALET - minimum RM2 for top-up via MPay WALET e-wallet transfer.

c. Bank deposit - funds can be deposited via DuitNow, RENTAS and/or IBG. The minimum transfer will be based on the respective banks’ minimum transfer limit. (Copies of documents such as Payment slip, User name, IC number and phone number are required to be provided via email to operation@quickash.com ). The deposits made via bank channels will take up to 3 working day for processing.

On the other hand, there is no maximum limit on the amount of funds you can add to your QuicKash account. You have the flexibility to deposit larger amounts as per your investment needs and preferences. However, it is encouraged that retail investors limit their total investments to a maximum amount of Ringgit Malaysia Fifty Thousand (RM50,000.00) at any given time and for any duration.

13. Risks involved in P2P investments.

a. The financing is not collateralised

While the financing provided through Investment Notes on QuicKash's platform is generally not collateralised, QuicKash aims to enhance investor protection by obtaining personal or joint and several guarantees from the directors and/or shareholders of the issuer whenever possible. These guarantees serve as additional assurances for the investment notes issued.

Investors with a lower risk appetite are strongly advised to consider investing in Investment Notes that include a principal guaranteed element. This feature provides protection against the risk of losing the principal investment amount, offering an added layer of security. Please refer to FAQ 19.

QuicKash recognizes the importance of providing options for investors with varying risk preferences and seeks to ensure transparency and clarity regarding the risk profiles associated with different investment notes. It is recommended that investors carefully evaluate their risk tolerance and choose investment options accordingly.

b. Issuer Default Risk

Investing in any financial product entails the risk that investors may not receive their scheduled repayments due to an issuer's missed or defaulted repayments. To address this risk, QuicKash has implemented several measures. One such measure is requiring issuers to establish formal standing instruction arrangements to ensure timely and scheduled repayments.

In addition to QuicKash's efforts, investors are strongly encouraged to diversify their investment portfolio to mitigate potential default risks. By investing in different Investment Notes that carry varying risk profiles, investors can spread out their exposure and reduce the impact of any single issuer default.

Diversification is a prudent strategy as it helps to minimize the potential negative impact of default by spreading investments across multiple issuers and investment opportunities. By diversifying their risk, investors can increase the likelihood of receiving repayments from other investment notes, even if one issuer defaults.

QuicKash emphasizes the importance of investors considering their risk tolerance and diversifying their investments accordingly, enabling them to manage and mitigate the risk of issuer defaults effectively.

c. Investing without a good understanding of the Investment Note

It is essential to thoroughly analyze and understand the Issuer Project Brief/financial fact sheet provided within each Investment Note on QuicKash's platform. QuicKash has implemented a comprehensive credit assessment methodology to evaluate the viability and credit risk associated with each investment note. This methodology combines QuicKash's own credit score with that of a reputable Credit Reporting Agency, resulting in a comprehensive risk profile for every issuer.

QuicKash takes pride in publishing the Issuer's Credit Score, Risk Grading, and Probability of Default for each investment note hosted on the platform. This information is valuable in assisting prospective investors, including those who may not have extensive investment knowledge, in making informed judgments and investment decisions.

QuicKash welcomes any prospective investors to engage us via channels available (Hotline: 1700-818-727, Email: enquiry@quickash.com or whatsApp) for further queries and clarification on the credit scoring approach used to assess the credit risk of investment notes hosted on our platform.

14. How long is the investment tenure?

Investment tenure varies from one investment note to other, typically in the range from a minimum tenure of 1 month to as long as 24 months.

15.What are the details of the Issuer available to me before I invest?

Prospective Investors shall be furnished with the details of the investment note which include the target amount to raise, raised amount, credit scoring by QuicKash, financing tenure, rate of return, type of financing, type of business, listing duration, monthly repayment schedule, investor fee, minimum amount to fund (at 80% of targeted fund) and borrower's credit profile, Issuer’s financial information (where applicable) and purpose of financing.

16. What are the benefits of investing?

a. Grow your earning potential

b. Diversification of investment portfolio with scheduled returns

c. Contribute to your retirement funds

d. Mobile investment. Portable, pocket friendly

e. Licensed and regulated platform

f. Competitive rates of return

g. Diversification of investment risk

h. Bite size offerings, making it possible for anyone to invest

17. Why is my funds in the Frozen Status after I made the investment?

The funds will be locked or in Frozen after you invested in any investment note / financing. The funds will be unlocked in one of the following scenarios :

a. Upon successful completion of the fund-raising campaign, the funds will be disbursed from the investors to the issuer.; OR

b. If the fund-raising campaign fails to reach the minimum 80% fund threshold within the specified financing period, the funds will be unlocked.; OR

c. In cases where the issuer decides not to proceed with the fund-raising campaign, the funds will also be unlocked.

18. What is the investment note that comes with guaranteed principal protection, and how does QuicKash ensure repayment to investors in such investments?

The investment note provides guaranteed principal protection, which means it is secured by collateral, subject to certain caveats, proceed/sales assignment by a third-party corporate guarantor, or it is guaranteed by an appointed entity such as an insurance company or any Credit Guarantee Corporation and etc.

Please note that it is not guaranteed by Quickash Malaysia Sdn Bhd

In the event of defaulted, there is a possibility that your initial investment may be subject to extended holding periods or the potential for a partial or complete loss of principal. Although the Guaranteeing Entity assures the return of the entire or partial invested principal, there exists a potential scenario in which the Guaranteeing Entity may be unable to meet its obligations within this agreement.

The realisation of the underlying collateral and/or the involvement of the Guarantor(s) is contingent upon the outcome of legal proceedings and the judgment rendered by the court. This process may be time-consuming in nature.

19. How do I know which investment note comes with guaranteed principal protection?

FYI. Not all the financing / investment notes listed in QuicKash carries a guaranteed principal protection element.

So, the easiest way to identify a principal protection investment note is by looking out for an the Investment Note number that includes the annotation : "GTD RTN" (for example : WC22XXXXXX001 GTD RTN). You will get to learn more when you click and read the content of the investment note.

20. Does it guarantee the interest element also?

The guarantee component is dependent on the extent of coverage provided by the guarantor. Certain investment notes may include coverage for both the principal amount and the accrued interest. For more detailed information regarding the investment note financing, please refer to the investment note financing factsheet. It will provide comprehensive details and specifics about the terms, conditions, and coverage associated with the investment note.

21.How to view any repayments received from issuers? (via mobile apps)

1.To access the details of payment received, please navigate to the mobile app and go to

"Profile -> My Investment -> Paid."

There, you will be able to view past transactions and any repayments received from the issuer.

2. For information regarding restructured or moratorium repayments received, go to

"Profile -> My Investment -> Restructured."

You can tap on the respective notes to access extended details about the repayments.

22. In the event of overdue payments from issuers, would the investors be entitled to any late penalty or compensation?

Investors are generally not entitled to any late penalty fees or compensation from overdue issuers, unless there is a restructuring of the Investment Note. In such cases, investors may be eligible for extended interest payments, which are determined on a case-by-case basis. The eligibility for extended interest payments depends on the repayment capability of both the issuer and the guarantor.

23. The reasons for withdrawal failure.

If a withdrawal fails, it could be due to an incomplete entry in the "Reference/Reason" column, resulting in a timeout due to the withdrawal screen remaining idle for too long. Investors must complete the withdrawal process within 60 seconds and ensure they input the appropriate "Reference/Reason" (e.g., Withdrawal) to facilitate a successful transaction.

Additionally, a failed withdrawal could be attributed to an incomplete or unregistered bank account. To resolve this, you can access your Profile and select the "Withdraw" option. Follow the provided steps to register your preferred bank account, which will be credited with the withdrawn funds. Once your bank account registration is approved, you can proceed with the withdrawal process as usual.

24. Frozen amount after failed withdrawal

If investors fail to withdraw their money, a frozen amount will be displayed in their account balance for approximately 10 to 20 minutes. However, the original amount will be restored in the "Account Balance" shortly thereafter. Investors can then make another attempt to initiate the withdrawal process.