1. Who can be an Issuer?

Issuers must be locally registered businesses. Either as sole proprietorships, partnerships, incorporated limited liability partnerships, private limited companies, or unlisted public companies.

2. Can I settle my financing earlier than the tenure?

Yes, you can repay funds raised before maturity at no additional cost.

3. How much money can I raise with QuicKash?

We have two products offered, each with different limits:

- Programme Financing: Allows issuers to raise RM25,000, RM50,000, and RM100,000.

- Business Financing: Allows issuers to raise amounts above RM100,000.

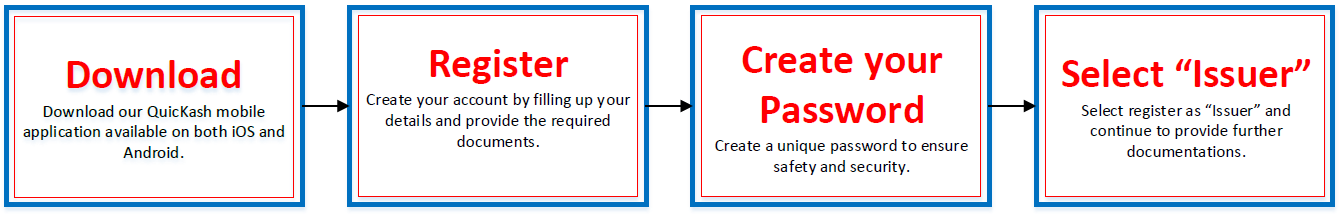

4. How do I register as an Issuer on your platform?

Please note that all registrations are subject to a know-your-customer (KYC) approval.

5. What documents are required to apply?

(Click here) for Program Financing document checklist (Click here) for Business Financing document checklist |

6. What are the charges for Issuers to raise funds on the QuicKash platform?

Breakdown of the fees payable by Issuers are as below:

- Processing Fee: RM100.00 (per application)

- Platform Fee: 2% - 3% of the investment note successfully funded + 1% sinking fund

- Stamping Fee: 0.5% of the investment note successfully funded + RM10 / subsequent document copy

- Guarantee Fee: At a rate determined by QuicKash for guarantee services provided by third-party guarantees (only applicable for Guaranteed Notes).

7. What are the types of financing available with QuicKash?

- Working capital financing

- Supply chain financing

- Demand chain financing

- Collateralized financing

8. How long is the repayment period?

Usually up to 12 months.

9. What if I am unable to repay?

If you have problems meeting your repayment obligations, contact us early to discuss repayment alternatives. Do note that upon default, the following fees may be imposed:

- Default Fee

- Penalty Fee

- Overdue Fee

- Other interests and fees as may be applicable, as outlined in our Issuer Terms and Conditions

NOTE: If you are not able to find the answer to your question or for a more in-depth answer, please refer to our Issuer Terms and Conditions published on this website. The FAQ will be updated from time to time to reflect any changes to the terms and conditions. The company reserves the right to change these terms and conditions at any time without prior notice.