Article 1:

What you need to know when investing in P2P Financing?

Peer-to-peer (P2P) financing has gone from a hot fintech trend a few years ago to a popular and legitimate way for investors to earn a stream of income today. And it has landed on our Malaysian shores.

As this type of financing gains popularity because of its relatively high expected returns and low-cost entrance into the market (an investor can start with as little as RM100), we look at what P2P financing is, and examine some of the possible risks and rewards.

What is P2P Financing?

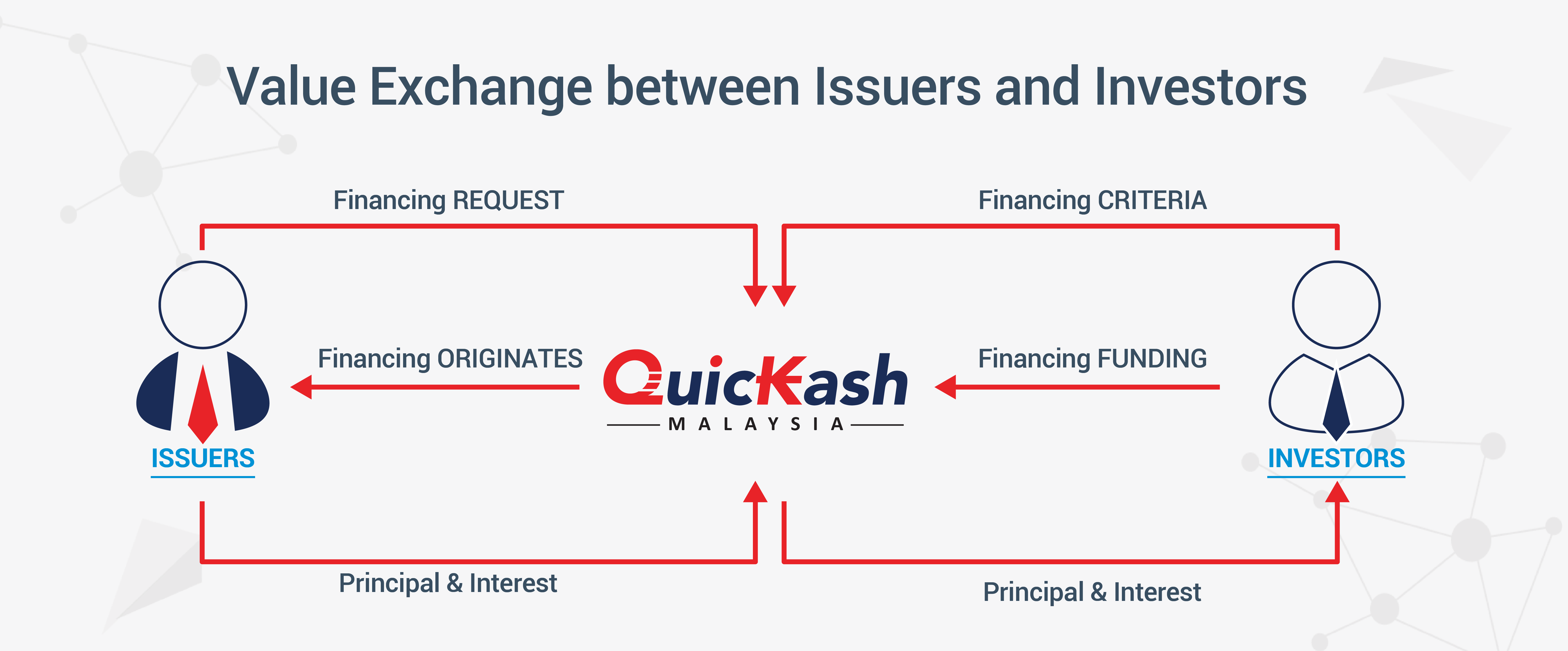

P2P financing leverages different types of technology from online payment and investing capabilities, to Big Data that predicts the likelihood of repayment to create interest rates. It then anonymously matches investors with issuers via online services like QuicKash based on factors, such as risk/reward, interest rate/return, credit report, debt-to-income ratio, and type of loan(personal, small business or refinance).

For example, an issuer can request a loan for RM10,000. An investor would lend a portion of that amount, this could be any amount, from as little as RM100 to the full amount.

If you decide to only put up a portion of the financing amount, then you would share that note with other investors. This is where diversification comes in; the more you spread out your investments among many noted, the lower your risk.

By eliminating overhead costs like physical branches, we channel that savings to lower costs for investors.

P2P History and Projected Growth

Born from the financial crisis of 2008 and the resulting banks' tightening of financing standards, P2P financing is a great option for businesses that Big Banks either won't finance or will charge more for. It also gives some investors the chance to capitalize on high interest rates.

How Money Is Earned

QuicKash does make money from offering the platform. How else would we be able to maintain the platform for you to grow your wealth? Here is how :

- We levy a platform fee to the issuers. The charge is between 2% - 3% of the total financing amount, depending on the individual issuer's credit scoring.

- We collect 1.25% - 1.5% Investor fee on the repayment amount by the Issuer.

The monies gained is channeled towards maintaining our website and to cover operations and marketing costs.

Some Pros of P2P Financing

Opening an account online is easy and inexpensive; at QuicKash, initial investments start at RM100. Here are some benefits of investing into listings on QuicKash's website:

- Diversifying risk is possible and wide-ranging as investors can fund hundreds of financing with varying risk grades

- Higher average returns than bank CDs, but potentially with more risk

- Potential to collect monthly income via repayments and interest from issuers

Exercise Caution with P2P Financing

Potentially, the returns are as high as 18%. A medium-risk, well diversified portfolio should be in the high single digits, 7%-to-9% range.

Ultimately, QuicKash is an innovation that creates more choice for investors and issuers. As with any investment, it is important to consider how this type of investment fits into your overall portfolio and whether it can help you better achieve your financial goals.

Article 2:

Don't Put All of Your Eggs in The Same Basket!

A Guide to Diversification with QuicKash

Diversification is common place in every investor's dictionary. The benefits of creating a portfolio with various asset classes are aplenty. To begin with, it reduces risk. Or rather, it assists with aggregating formidable returns despite one's risk appetite. Every investor chooses a level of risk based on financial goals, a period of investment and tolerance to volatile markets. Diversifying helps offset damages from asset classes that perform inadequately; asset classes that looked promising to your palate.

Diversification is the holy-grail that all financial advisors swear by, especially with traditional financial instruments. But there is a new kid on the block who's broadening the pool of opportunities for diversification. With high returns and easy tenures, P2P financing is a great addition to any diverse portfolio. Furthermore, additional diversification within one's P2P asset class can generate returns between 8 & 18% percent annually. It is an asset class that represents the best-case scenario with risk/reward congruence. Are you new to this scene? Here are a few things you should know :

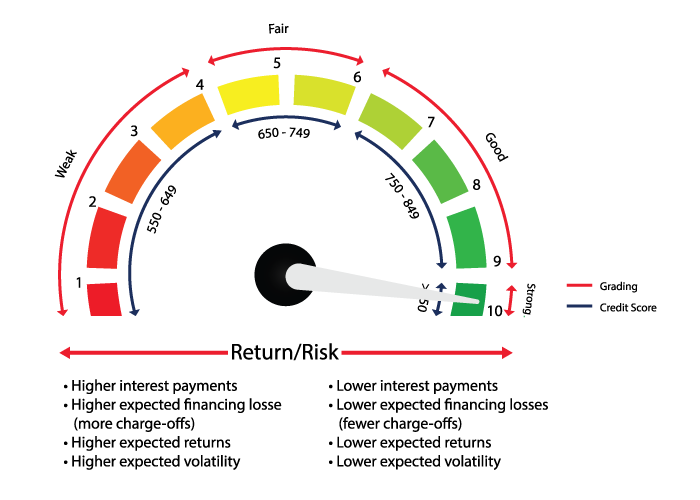

With P2P financing, the risk is inversely proportional to the issuers' credit score. Lower the credit score, higher the risk and vice versa. Issuers fall under high, medium, and low-risk categories in line with their credit score. But lower the credit score, the higher the risk premium. Now a fraction of us might believe that high returns lie with the higher premiums. But that's where we're wrong. It is a result of smart diversification, coupled with the power of compounding.

1. Determine your targets

This includes all aspects of your portfolio. Your financial goals, the time horizon within which you want to achieve them and levels of risk you would like to work with. The diversification can unfold in any manner; be it geographies, risk-grades, demographics, platforms, and professions. Make sure to determine the same as well. The most successful diversification occurs across risk grades and platforms. In this case, let's take the risk grades.

2. Invest across Risk Spectrum

Avoid saturation by investing across issuers with different credit scores. Invest as many listings as possible to those belonging to risk grades within your diversification strategy. Our QuicKash simulation has shown that the more listings you invest in, the more positive the results.

Secondly, achieve balance. Gauge the various risk grades, and invest across the spectrum. An ideal approach would be investing at a ratio of 5:3:2 across low, medium, and high risk listings respectively. This would cap any losses incurred from the high risk issuers.

3. Reinvest. Reallocate. Rebalance.

For healthy diversification, periodic check-ups and rebalancing are essential. Review your portfolio, and reallocate where you see fit. With P2P financing, it is a matter of regular income, which if not reinvested, can't amount up to the 18% percent you're expecting to reap.

Whether you'se about to discover this realm on your own, or with an expert, start investing in P2P financing! Start your P2P venture with QuicKash, and be a part Malaysia's most diverse & reliable platform today.

Article 3:

Understanding the risks of peer-to-peer financing.

P2P platforms create a marketplace for investors to invest money directly to individual businesses or Issuers. In return, they receive an attractive yield - provided the issuer does not default. This nascent sector is not without its risks, however, so it is important to do your homework before you invest.

Default can happen

Investing in peer-to-peer loans is not the same as putting your money in a savings account. There is no guarantee that the cash will be repaid. The fact that you are putting your capital at risk is reflected in the higher interest rates that P2P financing offer, particularly in comparison to deposit accounts.

One of the biggest risks associated with P2P is that the issuer fails to repay the loan in full. The good news is that QuicKash have sought to mitigate the impact of possible defaults by creating provision funds that can be used to reimburse investors.

Although shares can be higher risk and more volatile, the returns on offer are potentially higher, so investors must work out what risk-reward balance they are comfortable with.

Understanding the platform

It is also important to understand the type of financing that is being undertaken. How much information do you have on the underlying issuer?

The next stage is to ascertain whether the loans are secured - and if so what against. If a loan is secured against property, look for a low loan-to-value ratio. If the loans are unsecured, make sure the platform focuses on higher quality issuers.

Given that many P2P platforms have not been through a full credit cycle, try to gauge the company's track record to date, alongside the experience of the team.

Five tips for successful P2P financing

- Learn the basics of P2P financing before you invest any money.

- Only invest when you feel confident that you understand enough about how the market works.

- Set yourself strict criteria or rules before you start investing. For example, if you invest in notes secured, against property, look for a maximum loan-to-value ratio. Alternatively, set yourself a minimum interest rate on prospective notes.

- Always spread your risk across different issuers.

- Stick to the rules that you set yourself!